6 Years Savings, 20 Years of Guaranteed Income!

Top 10 Benefits:

1) Guaranteed 6 Years Premium Paying Duration.

2) Guaranteed 4%p.a Annual Cash^ for end of Year 1 to 6.

3) Guaranteed 6%p.a Annual Cash^ for end of Year 7 to 12.

4) Guaranteed 8%p.a Annual Cash^ for end of Year 13 to 20.

5) Protection on Death/TPD.

6) Additional Protection of 100% basic insured amount on Death/TPD occurs as a result of an accident.

7) Upon death/TPD, remaining annual cash until maturity shall be payable in a lump sum.

8) Annual Cash Dividends from end of Year 1 until maturity (Projected at 4% of Basic Insured Amount).

9) Guaranteed Cash Value upon Surrender/Death/TPD/Maturity.

10) Terminal Dividends payable upon Surrender/Death/TPD/Maturity.

For more info, please send your euquiry to cheahyang_0@hotmail.com today!

Hurry! This endowment plan is a closed-end product and it will be withdrawn on October 2011.

Remarks:

^ The return rate of the annual cash is based on basic insured amount.

This post contains only a brief description of the product and is not exhaustive.

For a detailed explaination, please arrange an appointment with me for further discussion (KL area Only).

Sunday, October 2, 2011

Wednesday, May 26, 2010

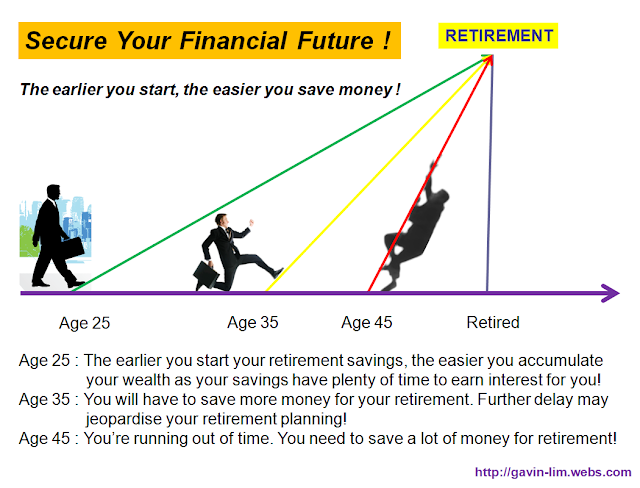

Why Should We Start Early for Retirement Planning

When It Comes To Retirement,

It Doesn't Matter How Much You have Earned.

What Will Be Mattered Is How Much You Have Saved!

Monday, November 2, 2009

Retire From Work, Not From Life.

ING I-Retire :

Short Premium Paying Duration - 20 years or up to age 60, whichever is earlier.

Guaranteed Annual Retirement Income - Upon reaching age 55, you will receive a guaranteed annual retirement income till age 85. Another interesting point is that you get to decide how much you intend to receive at the time you buy this plan!

Dividends - ING I-Retire also pays dividends. Dividends are not guaranteed and depend on the performance of the Company.

Family Income - ING I-Retire also pays out family income (equivalent to your annual retirement income) annually for a maximum of 20 years if death or total and permanent disability happens before or upon age 45. The number of annual payment reduces if death or disability occurs after 45, but before age 65.

ING I-Retire not only gives you more flexibility to reach for the dreams you aspire but it can also aid in offering security to your family. Retirement is definitely easier with ING I-Retire.

Short Premium Paying Duration - 20 years or up to age 60, whichever is earlier.

Guaranteed Annual Retirement Income - Upon reaching age 55, you will receive a guaranteed annual retirement income till age 85. Another interesting point is that you get to decide how much you intend to receive at the time you buy this plan!

Dividends - ING I-Retire also pays dividends. Dividends are not guaranteed and depend on the performance of the Company.

Family Income - ING I-Retire also pays out family income (equivalent to your annual retirement income) annually for a maximum of 20 years if death or total and permanent disability happens before or upon age 45. The number of annual payment reduces if death or disability occurs after 45, but before age 65.

ING I-Retire not only gives you more flexibility to reach for the dreams you aspire but it can also aid in offering security to your family. Retirement is definitely easier with ING I-Retire.

Subscribe to:

Posts (Atom)